I often discuss the ‘value’ of points, and how the value of your points is variable. That’s what makes points so great: the potential value can be high if you know how to redeem them to maximize their value. A key question, then, is how you determine the value of a redemption before you redeem your points for it. That’s what I wanted to discuss here.

- Why should you care about calculating points value?

- The formula: this is how you calculate redemption value

- An example: flying business class from New York to Amsterdam

- Summary

Why should you care about calculating points value?

The value of your rewards points is variable. You may be able to redeem is for 2 cents per point, but if you’re not careful, you may also end up redeeming it for less than 1 cent per point. Since I value points at a flat 1 cent per point, redeeming for less than 1 cent per point means you lose money. As such, it is best practice to calculate what value you get out of a certain points redemption before you go through with it. This will help you understand how good of a deal you’re getting.

Is the calculated cent-per-point value the be all end all? That is, if you find that you’re getting 5 cent per point, for instance, does that means you’re definitely getting a good deal?

No, I wouldn’t say so. I bring this up as a preview to the conclusion of this post, where I’m showing an example of a redemption opportunity on Swiss. The truth is that the value you’re calculating will be in reference to the cash fare you’d be paying for the flight, but you have to keep in mind that the cash value may be bad value in and of itself… This can trick you into thinking your redemption is good value because it may skew the cent-per-point value.

How do you get around this? You will want to look at cash fares on several airlines, as well as on a variety of dates, to see how prices change between different days of the week, and high and low seasons. The example that will follow later in this post illustrates that a business class fare on KLM is half price compared to Swiss, but that doesn’t mean that Swiss is twice as good of a product (see the below images for reference to their respective seats). So, make sure to read reviews, such as on Points to Seats, to understand if the cash fare is reasonable, and thus whether the valuation is actually good, whatever the cent-per-point valuation is.

The formula: this is how you calculate redemption value

In order to calculate the redemption value of your points, you need to find the equivalent cash fare of the flight, the total points required for the redemption, and any taxes and fees that must be paid as part of that redemption.

The equivalent cash fare should usully be found by going to the website of the airline that operates the flight. For example, if you’re looking to redeem for a flight with KLM, you should check the equivalent cash fare on the website of KLM. The points required and applicable taxes and fees should be checked with every airline that offers the option of redeeming points for that particular flight – or at least, check with those airlines where you cna transfer your points to. Once you have that information, this is the formula to calculate the redemption value, in ‘cents per point’:

((cash fare – redemption taxes and fees) / total points required) x 100

An example: flying business class from New York to Amsterdam

Let’s put this into practice by looking for redemptions for business class flights from New York to Amsterdam. We will search for some award flights, calculate the redemption value of the points.

To start, I like to do a cursory search in Seats.Aero. I’m, using the random date March 17th, 2025. A variety of flights pop up that can be redeemed through Air France/KLM’s Flying Blue, Alaska MileagePlan, American AAdvantage, Air Canada Aeroplan and others. The only direct business class flight is through Flying Blue, for 92,500 points (indicated in the red rectangle). But let’s take note of the options through Air Canada and United as well (light blue rectangles). I’m usually not too excited about OneWorld flights to Europe, since they are often operated by British Airways and come with hefty taxes and fees ($1000 and up). Let’s look Flying Blue first, since it’s the only direct redemption option.

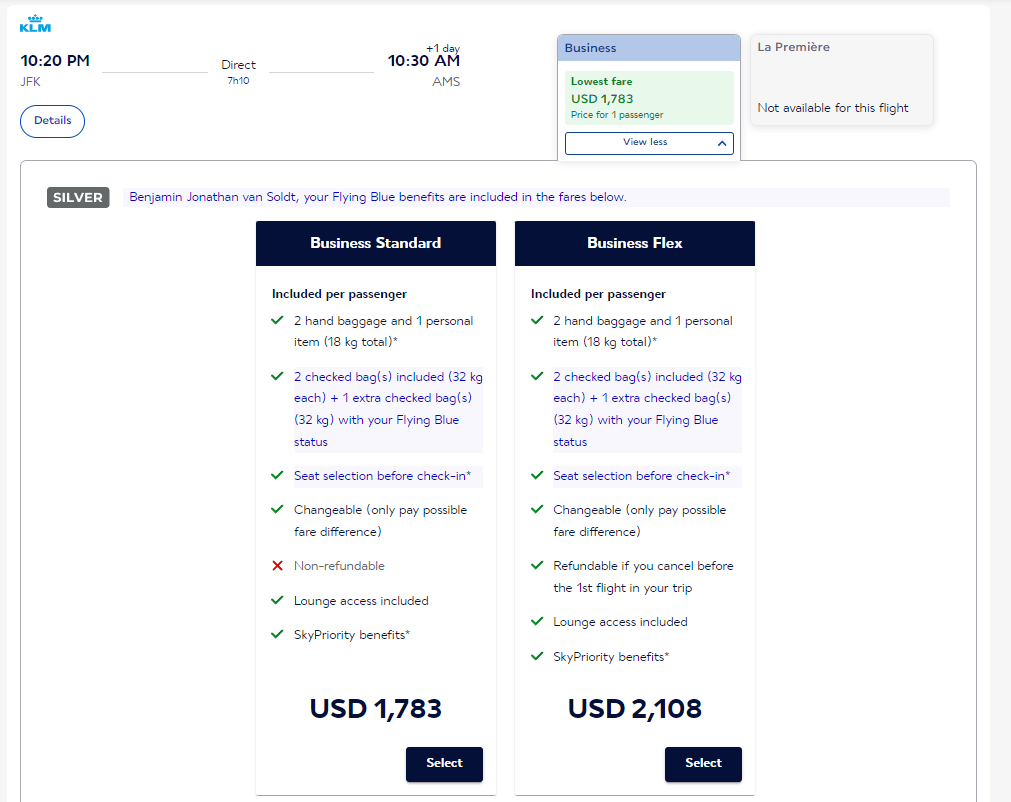

We can go into KLM’s booking system and find the cash price for this flight. It appears to be $1783, including any taxes and fees.

We can also confirm that the redemption price that we saw before is indeed present, and how much has to be paid in taxes and fees. We indeed find it for 92,500 points, plus $227.50.

Knowing this, we can put the formula into practice:

((1783-227.50)/92,500) x 100 = 1.68 cents/point

In my book, this is not a good redemption, as I always aim for at least 2 cents per point. Besides, it is usually possible, with some searching, to get a one-way business class flight on Air France for 50,000 points, plus taxes and fees, so paying 92,500 points is a bummer. Just as a thought experiment, let’s see what the valuation would be if it were only 50,000 points:

((1783-227.50)/50,000) x 100 = 3.11 cents/point

…which is a much better deal. But, given the reality of the current redemption, let’s have a look at the flights that have 1 stop. In my experience, the OneWorld (Alaska and American)_ redemptions on routes to Amsterdam are operated by British Airways, which carries hefty taxes and fees (upwards of a $1000), so I won’t look at that right now. Instead let’s look at the Swiss flights that were listed, which can be redeemed through Air Canada Aeroplan or United MileagePlus, as you can see below. These flights are either 70,000 or 88,000 points, so you’d be spending less points overall. Let me be clear, though that Air Canada can also offer these flights for 60,000 flights, so again, the current pricing we see here is not ideal, but not as bad as the KLM flight above.

If we go to the website of Swiss to see what the cash price for this one-way flight is, we see that it is $3615.80! That is a rather crazy price I think, given that KLM was half of that price. Especially taking into account that the product of Swiss is not necessarily twice as good as that of KLM. Be that as it may, let’s do some calculations.

If we go to Air Canada, we find that the flight costs 70,000 points, plus 103 CAD, which is 74.64 USD at the time of writing.

If we then go the website of United, we see that here the flight costs 88,000 miles, plus $24.10. It’s good to highlight the difference in taxes and fees, because you may find that sometimes this difference in taxes can offset any difference in points value between redemptions options.

Let’s do the calculations for Air Canada and United’s redemption oppertunities:

Air Canada: ((3615.80-74.64)/70,000) x 100 = 5.06 cents/point

United: ((3615.80-24.10)/88,000) x 100 = 4.08 cents/point

Given these two calculations, Air Canada offers a better deal than United, and also better than KLM. That said, I want to emphasize that this is not the be all end all. For many, the absolute number of points spent is an important metric, as is the the value of the product itself. Like I mentioned before, I do find the $3615.80 price that Swiss asks for this flight to be rather outrageous, so it’d be worthwhile to further optimize the dates and routing to get a quote that is more realistic, since I doubt that Swiss business class is actually that much better than KLM…

But, based on these valuations, going for the Swiss flight, redeeming through Air Canada, gives you the best valuation, at over 5 cent/point.

Summary

In this post I’ve presented the formula that will allow you to calculate the cent-per-point value that you’re getting from a points redemption, and I’ve shown an example of how to put this in practice. Still, there are nuances and subtleties to be aware of, so even if you get a valuation that is in excess of 2 center per point, don’t assume that’s necessarily a great redemption. Take you time to read some reviews to understand if the advertised cash fare that you used for your redemption seems reasonable, and explore other redemption opportunities with different airlines, if available.

Have questions? Need advice on whether your redemption seems reasonable? Contact me for free consultations and advice! Submit the contact form here.

Leave a comment