In the past two iterations of this series I first wrote about the importance of having clear rewards goals in order to setup your flight redemption strategy, and then I talked about the two general types of rewards cards, namely cash-back card and points rewards cards. With that out of the way, now I’d like to talk about what card specifically to pick once you know what you want to redeem points for.

Let me start by pointing out one thing though: don’t get a credit card if you feel like you are overstretching your budget already. Acquiring welcome bonuses makes no sense if you spend more than you normally would, in order to make the spend requirement!

- What are the choices?

- It usually makes sense to choose a bank’s credit card

- When does it make sense to apply for a co-branded credit card?

- Additional considerations

- An example: why did I pick up the IHG One Rewards Premier card?

- Summary

- Discover more from Points to Seats

- Recent posts

- join the newsletter

- Topics

- Follow ME

What are the choices?

When it comes to points rewards credit cards, you really have only two options: a credit card that is issued as part of a bank’s own, independent credit card portfolio, and credit cards issued by a bank in partnership with a third party (co-branded credit cards). Which card you apply for has implications for the benefits that you receive and, quite importantly, the account where your rewards points accumulate.

Typical benefits of an independent credit card

When I talk about an independent points rewards credit card, I’m referring to credit cards that are offered by a bank independently from a third party. Examples are the Chase Sapphire, the Citibank Strata Premier, or the Capital One Venture X. I have previously listed some of my favorites.

With these sorts of cards, any points you earn will accumulate in your rewards account at the bank that issues the card. So, if you put spend on your Chase Sapphire, the resulting points will end up in your Ultimate Rewards account. From here, the points can be transferred to third parties, spent at the Chase travel portal, applied to purchases as ‘cash back’, or used for one or other of different options that Ultimate Rewards provides. Importantly: the points balance can usually not be transferred to the rewards account of a different person (e.g. a family member), nor can they be transferred to the rewards program of a different bank (e.g. from Chase Ultimate rewards to Citibank ThankYou).

Besides the rewards points, different credit cards will come with a variety of different perks, and the quality of those perks is usually correlated with the annual fee of the card. It stands to reason that the higher the annual fee, the better the perks will be as well. These days, we see a variety of cards offer one or more of the following types of perks:

- Collision Damage Waiver insurance for rental cars;

- Trip delay and cancelation insurance, which may pay for meals or hotels;

- Lost or delayed baggage insurance, which will pay for the purchase of everyday necessities;

- First-party lounge memberships, such as Chase, Capital One and Amex Centurion lounges.

- Third-party lounge memberships, such as Priority Pass;

- TSA Precheck and Global Entry fee waivers, which pay the application fees for these services once every four years.

Typical benefits of a co-branded credit card

The second category of rewards credit cards encompasses cards that are co-branded, meaning that they are issued in partnership with a partner. This includes hotels, airlines, stores… Practically any company could issue a credit card through any bank. Examples are the Alaska Air Visa Card, the IHG One Rewards Premier Card, and the Amazon Prime Visa Card.

These credit cards are somewhat trickier to put a value on, since their value tends to be very personal. That said, typical perks are as follows, with different cards offering different combinations of these and other perks:

- For airline co-branded credit cards:

- Increased point-per-dollar earning with the airline partner.

- One free piece of checked luggage.

- Free standard seat assignment.

- Some sort of priority boarding, typically with the highest economy tier (different airlines have different names for this group).

- For hotel co-branded credit cards:

- Increased point-per-dollar earning with the hotel partner.

- Lowest-tier elite status as long as you have the card.

- A free-night certificate upon account anniversary.

- Some kind of welcome amenity upon check-in (a drink, a snack, etc).

- For store co-branded credit cards:

- Increased point-per-dollar earning with the store partner.

- Some sort of discount at the store partner when paying with the card.

It usually makes sense to choose a bank’s credit card

Between the independent and co-branded cards, it usually makes the most sense to apply for the independent ones. That is because they represent the most generalizable value: that is, they give you the most flexibility because you’re not putting all your eggs in one basket. For example, the Amazon Visa Card will accumulate rewards for use specifically with Amazon and the Alaska Visa Card will accumulate miles in your Alaska Airlines account. If you want to use your points or miles elsewhere – you can’t. With independent cards you can aply your rewards to most any purchase – hence the flexibility.

There’s another dimension besides the flexibility: the rate at which you earn your points or miles. Co-branded credit cards will typically allow you to earn the most points-per-dollar at the partner. For the Alaska Air Visa Card, that would be Alaska Airlines: that card rewards you with 3 miles per dollar spent at Alaska Airlines, but not elsewhere. Hotel and store co-branded credit cards are similar, with varying rates. If you now have a look at the points earning rates of a card like the Chase Sapphire Reserve, it awards 3 points per dollar for all travel, be it with Alaska or not. As such, you can get that same 3 point-per-dollar reward, but applied to a much larger percentage of your overall spending. So again, much more flexibility.

Now, assuming that you decided to go with a bank’s credit card, and now you have a bunch of points. Now what? Again, flexibility is the keyword. Chase, Capital One, Amex and Citibank all allow you to transfer your points to select travel partners, including various airline and hotel partners. You can also pay yourself back in cash, or apply your points to purchases through ‘pay with points’. As such, those points that you earn can be used in a variety of useful ways rather than just being useful for one specific partner.

One thing I haven’t touched much on here are cash back rewards cards. In part because this post is much more so about points rewards cards, but I thought I’d briefly mention these cards in this context. Because if you’re looking to get a cash back card, I would still say that the bank credit card is likely to be the most flexibile choice. For example, a card such as the Chase Freedom Preferred card will allow you to pick a 5% cash back category, which is generally more than your typical store co-branded card.

So really, it all comes down to flexibility to do with your rewards what you want, and a bank’s credit card is simply best for that without necessarily sacrificing your points earning rates. You’d still need to look closely at the earning categories of card and see how they match up with the co-branded store card that you’d be interested in, but I dare say that in most cases the bank’s card will outperform the co-branded card, certainly if the partner is in the travel business.

When does it make sense to apply for a co-branded credit card?

While I do think the independent cards typically make the most sense, there are specific cases in which you’d probably want to pick up a co-branded credit card. Generally, that situation would occur when you happen to deal with that partner often, regardless of whether it’s an airline, hotel or store. Here are the prime reasons to pick up a co-branded card:

When you necessarily have to deal with a particular company

The best example of this is if you happen to be located by an airport where one particular airline is dominant. For example, if you live in Atlanta, you’re likely to fly with Delta since Atlanta is a so-called ‘fortress hub’ for Delta Airlines: an airport where Delta is so dominant, that they control by far the largest chunk of the aviation market at that airport. Other examples are: American Airlines at Dallas-Fort Worth (DFW), United Airlines at Newark Intl (EWR) or Alaska Airlines at Seattle Tacoma (SEA).

In this case, it can make a lot of sense to get the co-branded card of the airline, as these cards tend to give you one piece of free checked luggage, priority boarding and the ability to select a seat free of charge. These perks can help you fly more cheaply by giving you the provisions of a ‘main cabin’ fare, even if you fly basic economy. And with basic economy, paying for a seat plus a checked bag can easily come at a $50 extra charge! So, there is definitely benefit to be had.

When you otherwise can’t consistently maximize your rewards earning rates

Here is another reason you may want to get a co-branded credit card: to maximize earning rates in categories other than travel, dining, groceries or gas. The focus on those categories means that there are a lot of stores that are more or less ‘left out’ from maximum points earning, and this is where co-branded cards can make sense, but only if you consistently buy at those stores and have a solid chance to redeem the rewards. If you shop at BestBuy once in a blue moon, there is really no good reason to get their store card. However, if you shop at Amazon several times a week, getting the Amazon Prima Visa card may be beneficial if that card maximizes your points earning over that of an independent card.

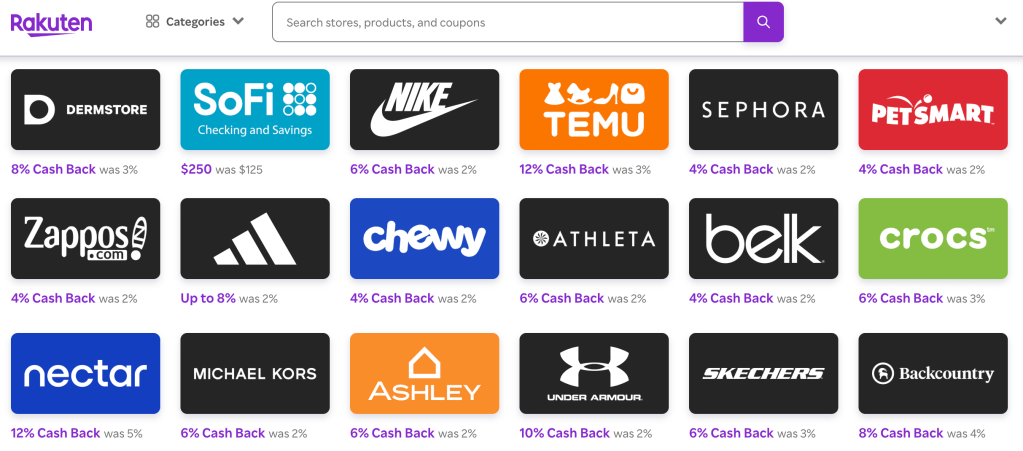

Good to know: Rakuten can help maximize rates!

The point I make in the above paragraph is certainly valid, but can also be dealt with fairly elegantly. Rakuten is a free service that allows you to earn variable cash back rates with a host of stores, so long as you buy online. In some stores you can also use Rakuten in person by linking a card to Rakuten directly, but it’s a minority.

If you’re okay with the slightly roundabout way of ordering online using a link found on Rakuten, and the picking up in person, you can achieve cash back earning rates of sometimes as much as 20%, as I was able to do a few weeks ago with PetSmart. This cash back is then sent to you by check, or, if you have an eligible Amex card, such as the Amex Gold card, you can also ask Rakuten to pay you out in Amex Rewards points (though it does seem like earning rates are a little lower if you choose that pay-out method).

Additional considerations

Once you have decided about a card category as per the above paragraphs, there are a few additional considerations. The most important are the welcome bonuses that are currently available, as well as the annual fee. A more minor element to consider is the specific additional perks that a card offers, and their ongoing usefulness.

Current welcome bonus

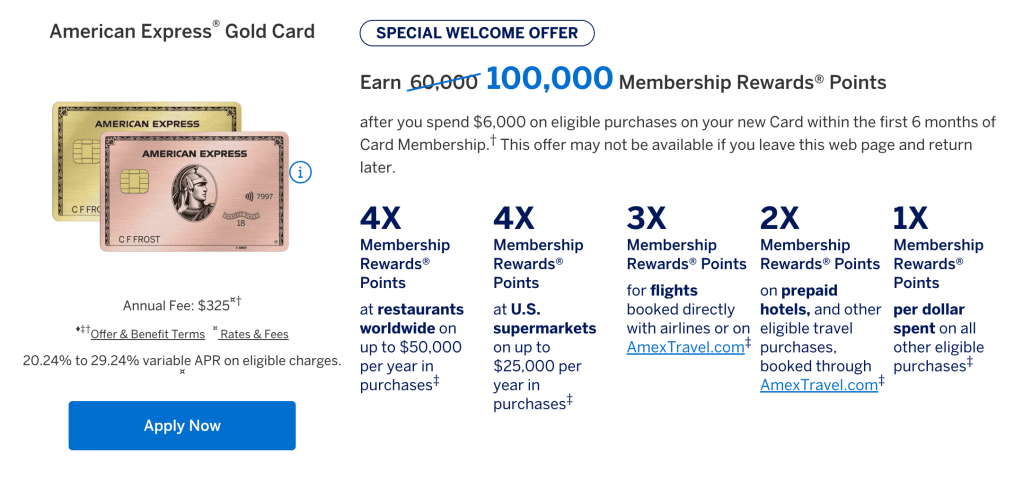

The welcome bonus is a way to quickly rack up a bunch of points, typically by completing a spend requirement. For example, Chase Sapphire cards usually run a welcome bonus of 60.000 points if you spend $4000 on the card within 3 months of account opening (which is not the same as the moment you receive the card). You will want to keep an eye on these welcome bonuses, because they can go up from the standard rate. For example, I applied for the Amex gold card because I was able to get 100.000 points after spending $6000 in 6 months – that’s 40.000 points more than normal!

You can check the link to see what the current welcome bonus is: Apply here for the Amex Gold card.

You usually can’t predict when a bonus goes up, so all I can suggest is to look periodically to see what the current offers are. It is advisable to get this right, though: many cards have a limit on how often you can get a welcome bonus, so you want to ensure that you’re getting the best deal. For example, the Sapphire cards allow you to get a welcome bonus on any Sapphire card within the family (either Preferred or Reserve) once every 4 years, while Amex allows a bonus only once in a lifetime per eligible card! So, definitely want to make sure you get the highest bonus on that one…

Annual fees

Another thing to think about is the annual fee of a card. While many cash back cards don’t have annual fees, points rewards cards can have them. The more you have, the more those fees stack up. There are ways to justify having them, which will be the topic of another post, but let’s assume for now that you’re flat-out spending money to get the card-associated perks. If you have a bunch of premium credit cards with high annual fees, you may not want to add another card with an annual fee.

Perk usefulness: now versus later

Finally, and though not as important as the above two considerations, you wan tto keep in mind what the card offers you besides the earning rates and welcome bonus. Does the card give you some kind of status with a partner? Some kind of useful memberships? And if they do, how long do they last? Will you be able to maximize the utility of that perk within the period that you have the card? For example, the Air Canada Aeroplan credit card gives you complimentary Star Alliance Silver status until the end of the next year since account opening, which is great! But if you then proceed to not fly a Star Alliance member airlines (e.g. United, Air Canada, Singapore Airlines, Lufthansa or others), then that perk is a total waste. So being strategic around such perks can be an incentive to get a card now – or hold off until later.

An example: why did I pick up the IHG One Rewards Premier card?

Let’s go with a live example. Recently I got the IHG One Rewards Premier credit card (and I wrote about that), which is a co-branded credit card issued by Chase. Sure, this is a co-branded credit card, even though I recommend to not go with a card like that. So what was the thought process?

This card had been on my radar

The truth is that the IHG One Rewards Premier card had bene on my radar for a while. I had come across it a little while ago and had actually meant to apply about a year ago, but didn’t, as there was another card that had made more sense. However, this card had stuck with me for the low annual fee and nice perks. Also, I had not had a hotel-branded credit card yet, and of all the different hotel groups, IHG made sense because of its lower price point.

There was an elevated welcome bonus

This was a big consideration to get this card now. The usual welcome bonus is 140.000 points upon spending $4000 within 3months of account opening. Currently the welcome bonus is 170.000 points, so an increase of 30.000 points. To my knowledge this is the highest it has been in a while, so certainly a good time to apply.

The annual fee is low and can be easily justified

Because the annual fee is not waived for the first year, it’s important to me that it’s easy to justify. Higher fees are harder to justify if the perks don’t make up for it. Fortunately, this IHG card is only $99, and it comes with an annual free night certificate, space-available room upgrades and platinum elite status with IHG. All that put together easily justifies the annual fee.

I will soon be staying at an IHG property

About thet elite status: it’s only useful if you actually go and stay with an IHG property. As it happens, in about a month we will be staying at the Holiday Inn at Frankfurt Airport in Germany, so it’ll be nice to see how the card can actually help us. I am hoping for a room upgrade.

Why IHG, and not another card?

There are several cards on my radar, including Air Canada Aeroplan, Capital One Venture X, Citibank Strata Premier, or potentially closing my Chase Sapphire Reserved and re-applying for a new welcome bonus on that card. So why didn’t I go one of the other routes? Briefly:

Air Canada Aeroplan: Right now there is an elevated welcome bonus, which is nice. However, this card is most useful if you fly Air Canada and its Star Alliance partners, especially because the card grants Star Alliance Silver status. I’m not going to fly Star Alliance airlines much in the near future, especially because my loyalty right now is with KLM/Air France and SkyTeam. As such it makes more sense for me to delay getting this card until I can commit to Star Alliance more.

Capital One Venture X: With this card you can get a welcome bonus once every four years, so while I’d like to downgrade my card to a no-annual-fee card and get the Venture X for a new welcome bonus, I simply wouldn’t be eligible.

Chase Sapphire Reserve re-apply: Like with the Venture X, I can get a welcome bonus once every four years. It’s been much longer than that so I’d be eligible, but I’d like to do this when there’s an elevated welcome bonus, rather than the standard 60.000 points. When that happens, I’ll certainly re-apply.

Citibank Strata Premier: This is a pretty nice card with a modest annual fee and some nice transfer partners, and the welcome bonus is pretty good too. However, the bonus categories aren’t all that useful in light of having the Amex Gold, and there aren’t too many perks that I’m interested in to justify the annual fee. However, the card will become very interesting if indeed Citibank becomes the exclusive transfer partner for American Airlines; then I’ll definitely apply for it!

Summary

To recap, the decision on what card to pick ultimately comes down to:

- The extent you can capitalize on your points: are you spending enough money with a particular company to justify picking up their credit card, or is it better to go with a bank’s independent credit card.

- The welcome bonus: see if there is a limited time elevate welcome bonus, or just the ‘usual’ welcome bonus.

- The immediate use of (expiring) perks: some perks are provided as long as you have the card, but others last only for a year or two. Make sure you can use those perks before they expire!

- Justification for the annual fee: Do the above points justify the annual fee?

Following that line of thinking, I recently got the IHG One Rewards Premier card, which had been on my radar for a while. I’m hoping this gives you some idea on how to go about thinking about what credit card to pick. If you need some guidance, of course I’m happy to advise! Just drop me a line through the contact form.

One last thing to reiterate: don’t get a credit card if you feel like you are overstretching your budget already. Acquiring welcome bonuses makes no sense if you spend more than you normally would, in order to make the spend requirement!

Leave a comment