Apply for the Chase Business Ink preferred HERE! Disclaimer: If you use this link, I do get rewards points upon your account approval. And, this is not financial advise – always ensure you fully understand the pros and cons of applying for a new credit card!

For a while now I’ve been looking into business cards – the next frontier for me, so to speak. The reason being that business cards can come with very large welcome bonuses – and a large spending requirement to match. Truth is, I was going to explain all these things in a series of posts, but I happened to receive my new – first – business credit card the other day and was very excited about it!

Specifically, I applied for the Chase Business Ink Preferred credit card. This is a business credit card with an annual fee of $99 per year. it is part of the ‘Ink’ family of cards, and includes cards in several flavors. The Preferred generally comes with the highest welcome bonus, and that is the primary reason I selected it.

The Ink Preferred’ s massive welcome bonus

Right up until September 5th at 7AM there was a heightened welcome bonus of 120.000 points with a spending requirement of $8000 – currently 90.000 points for the same spending requirement. To me, 120.000 points is worth 1200$ at the most conservative estimates (for example using the ‘pay yourself back’ option). By using Chase’s travel portal, I can get up to 1.5 cents per points thanks to another credit card I have: the Chase Sapphire Reserve. as such, the value of 120.000 points becomes at least 1800$. If you transfer the points to an airline partner, you may even redeem such points for much more valuable flights. Specifically, I’m looking to redeem these points for business class flights with Ethiopian Airlines to South Africa, which comes in at 88.000 points per one way segment – normally these flights cost in the range of 4500-6000$ return depending on the flight date.

Now, $8000 is not a small amount of money. It’s paramount that you are strategic around opening a card like this when you have ‘enough’ things to buy. I will often delay buying expensive things (if not of immediate need) until opening a new credit card. By accumulating the purchase of expensive things, it is then easy to fill a spending requirement.

What else does the card offer?

Although the welcome bonus is indeed exciting, the card has several other valuable perks. With spending you get additional points per dollar spent, although, being a business card, it does of course apply to categories that are not all around useful for non-business activities. As such, you get 3 points per dollar on the first 150.000$ spent per year on shipping purchases and advertising purchases, but also on travel and internet, cable and phone. These last two categories are generally valuable whereas the first two may only be useful for certain businesses. Besides such point rewards, there are also other perks, such as auto collision damage waivers for rental cars, cellphone protection, trip cancellation and interruption insurance, zero liability protection, fraud protection and purchase protection. Additional requirements need to be met for the coverage of these protections to kick in, notably that the card has to be used for payment of the service/device for the protection to kick in.

What is the application process like?

When I sat down to apply for the card, I did make sure to read up on the application process, and I generally read that I should expect to go into a ‘pending’ status, and approval would likely follow if you have a credit score over 740 (good or excellent categories). To my surprise, I received instant approval.

The Ink card being a business credit card, you do need to have a business. However, having an eligible business is easier than you think. You do not need to have a legally registered business, such as an LLC, in order to be eligible. Many activities that you may already be doing (selling things on Etsy or other such websites) can be eligible for what is called a ‘sole proprietorship’. Essentially it’s just you, running a business from your home. That said, and to reiterate: you do need to actually have a business, and always answer truthfully.

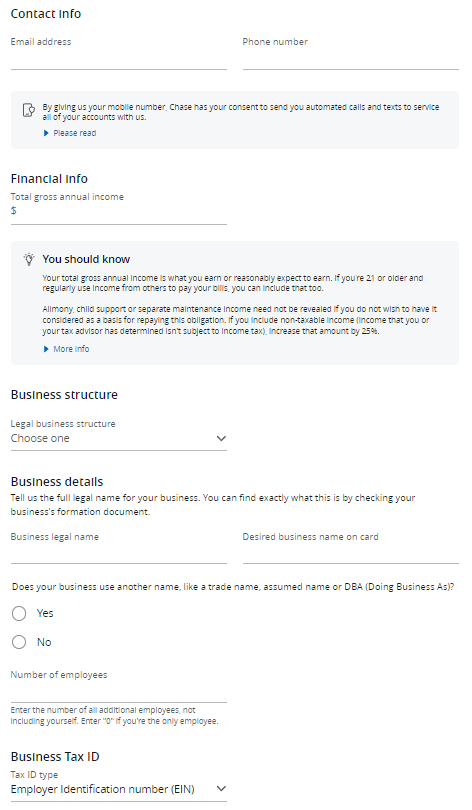

There are two parts, spread over the three screenshots I shared above. The first part is all about you. Like a standard credit card application, you are asked for your contact info and basic financial info, including annual salary. Fill this out as you would normally do.

For the second part, this is where things can be a little nerve wracking if you haven’t applied for a business credit card before. Here’s what I did:

- Business structure: sole proprietership

- Business legal name: Here I put my name – for a sole proprietorship, that’s fine.

- Desired name on card: Here I also put my name.

- Does your business use another name? No

- Number of employees, not including yourself: 0 – note I’ve seen variations on this. Sometimes the form seems to ask for total number, including yourself, so make sure to read the fine print!

- Business tax ID: I chose social security number

- Is your business physical address the same as your personal address? Yes

- Business phone number: my personal cell number

- Business established date: when I established my first business, which happened to be earlier this month (09/2024)

- Annual business revenue: 0$

- Estimated monthly spend: $1500 – this is a tricky one, because you want to give a number that is realistic, but not too high that it may effect your chance of approval, and not too low that it will affect your credit line.

- Employee card: I did not request one. Of course, if you say you are the only employee, you cannot be asking for additional employee cards…

This way I managed to get instant approval, and received the card after 7 business days. Since it was my first business credit card, I had to make a new, separate business online account with Chase. You can then link your personal and business accounts, which will lead to you being able to view all your accounts through business account, or, in the mobile app, once you login to both accounts, a little slider pops up that allows you to select between both.

Summary

It’s easier than it seems to apply for a business credit card. I applied for it using a fresh business I started and received instant approval, which also gave me access to a large welcome bonus of a whopping 120.000 points. I hope the details above are helpful for you to pursue an application for this card!

Leave a comment