Welcome back to this series on how I strategize around what credit cards to apply for. After I previously discussed how setting rewards goals is an essential first step in picking a credit card, in this part 2 I’ll talk about the types of cards that one can get, and the value I (don’t) see in them.

- Overview of types of cards

- Credit cards that earn cash-back

- Credit cards that earn points rewards currencies

- The value of points currencies stems from their arbitrary value

- Strategy is essential when maximizing redemption potential

- How does all this factor into my credit card strategies?

- But what if you don’t travel much?

- Summary

Overview of types of cards

To keep it simple, you have credit cards that earn you a straight up cash-back reward, and those that earn you a points rewards currency. The points currency can then be divided into a bank’s own currency (e.g. Chase Ultimate Rewards) or that of an airline or hotel (e.g. United MileagePlus miles). Of both these types there are many flavors but they fundamentally earn you the same things: either cash back, or points.

For both cards, the basics are the same:

- There will be certain categories where you can earn additional cash back or points. For example, with the Chase Freedom Ultimate you get 3% cash back on dining, 3% at drug stores and 5% on any travel bookings made through Chase’s travel portal.

- Both types of cards can be issued either by the bank as a standalone product, or in partnership with a retail store, hotel, airline or similar.

Credit cards that earn cash-back

These are the simplest rewards credit cards around, as they simply give you a dollar value back on every purchase. That dollar value can then be applied to purchases, like a credit. Depending on the specific card you’re using, the cash back percentage that you get will typically vary on the order of 1-5%, with 1-3% cash back being most common. This is quite literally money that you get back, as a reward for having used that particular credit card. So, on a 20$ purchase you’d get back 20 cents in case of 1% cash back. This can then be applied as credit to purchases.

Many stores offer versions of such cards, and typically, unlike rewards cards issued directly by a bank, the store cards will generate the most rewards when purchasing at that particular store. Overall though, regardless of what the specifics are, the cash back will pile up in the account you have at the bank or store partner, and the value can generally only be applied to the purchases made at that store or with that bank.

The thing to remember with these cards is that the rewards have a dollar value assigned to them: generally, 1 cent per point earned. So, if you can earn 3% back on e.g. dining, that translates to 3 cent/dollar spent.

Credit cards that earn points rewards currencies

Unlike cash-back rewards cards, cards that earn points currencies do not have a certain dollar value assigned to those points. This is what makes points currencies generally so valuable, if redeemed in a way that actually generates that increase in value. That said, the basics of these cards are usually the same, or similar, to the cash back rewards. Thus, there are usually certain spend categories that will earn you more points per dollar, and you can get these cards as an ‘independent’ product from an issuing bank, such as Chase’s Sapphire family of cards, or AMEX’s Gold and Platinum cards, or you can get them from a partner, such an airline or hotel.

The value of points currencies stems from their arbitrary value

So what makes points and miles rewards credit cards so attractive? Well, unlike a cash-back card, where there is an assigned value to the cash-back reward (1 cent cash back per dollar spent, usually), the points have an arbitrary value.

What does that mean? That 1 point does not necessarily equate to 1 cent. As such, if you get 3% on e.g. dining, you will get 3 points per dollar. If you are then able to redeem at a rate of 2 cents per point, you actually get a value of 6 cents per dollar, twice that of the cash-back card!

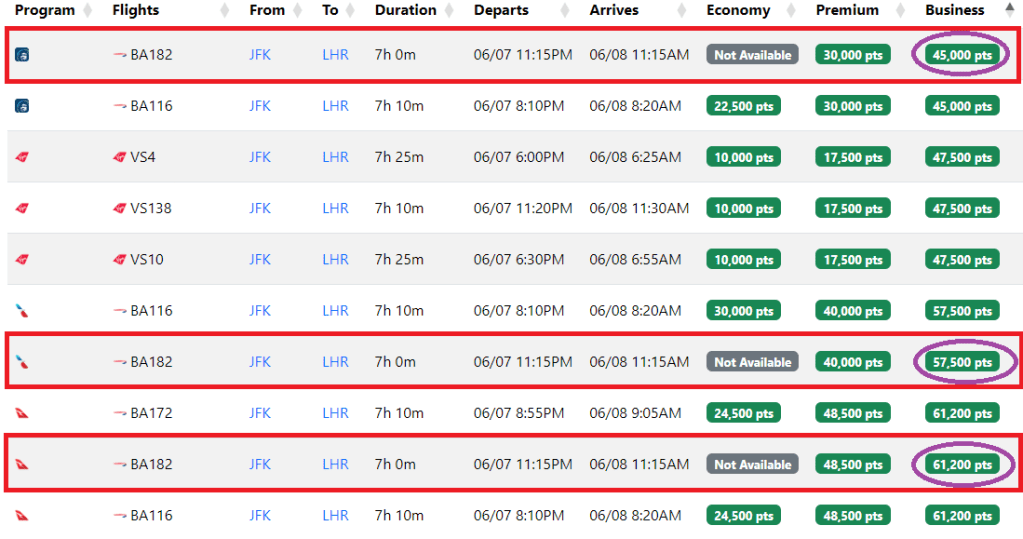

But how does that ‘variable’ rate work out in practice? For example, look at flight BA182 above, operated by British Airways from New York-JFK to London Heathrow. Business class tickets cost:

- 45,000 points (+ $995.30 in fees) through Alaska MileagePlan;

- 57,500 points (+ $732.30 in fees) through American Airlines AAdvantage;

- …and 61,200 points (+ $1027.80 in fees) through Qantas Frequent Flyer.

Thus: because the same flight can cost different amounts of points, the redeemed value of your points also differs. Maximizing the value of your points means getting the best redemption rate by finding the option that costs the least amount of points.

As an aside, you will see the fees, paid in cash, are very high on these tickets. This is an unfortunate problem with British Airways specifically, which is why I don’t particularly recommend redeeming points for flights on British Airways.

Strategy is essential when maximizing redemption potential

It then goes without saying that you need to be strategic with the type of points you amass. There are two rules that I follow:

- Bank’s point currencies (e.g. Chase Ultimate Rewards) are almost always the best. This is because of their flexibility and value. You can transfer them to airline and hotel partners whenever you see fit, so your points are never stuck with a certain airline, and once transferred you can generally redeem them for more than 1 cent per point. I will provide a full table of transfer partners in a later post.

- In some cases, it can make sense to invest in the points or miles of specific hotels and airlines (e.g. Delta SkyMiles or Hilton Honors). However, because you usually can’t transfer those points out of the airline or hotel loyalty program without losing value, you have to be sure that you have a way to use your points. For example:

- When there is a specific, lucrative redemption opportunity that you would like to make use of.

- If you are loyal to an airline or fly them preferentially, perhaps because they are the major player at your local airport.

- Some airlines are known for consistently offering good value through their program, so speculative investments in their points currencies can pay off in the long run. For example, Air Canada Aeroplan, Avianca Lifemiles and Air France/KLM Flying Blue have some great redemptions which make it worthwhile to invest points in them directly.

How does all this factor into my credit card strategies?

When I used Seats.Aero to find consistently available flights from NYC to Johannesburg on Ethiopian airlines, I found that these are consistently available through United Airlines (while generally bad value, there are exceptions!). To get the needed points, I chose to earn points through Chase, because:

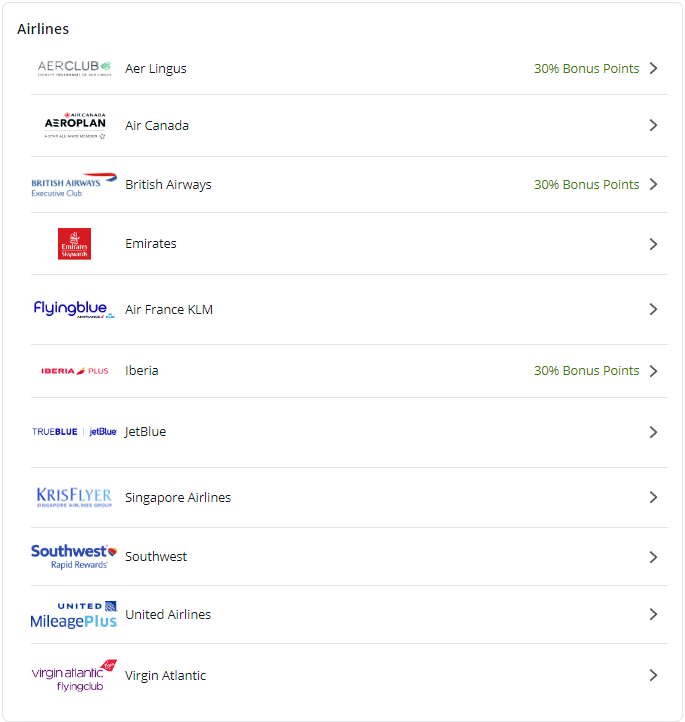

- If it turns out that the flight with Ethiopian is no longer available, I can still transfer the points elsewhere (see the below image), or redeem for cash. If using a United credit card, the points would be ‘stuck’ with United.

- Admittedly, the Bilt credit card also transfers to United, but they offer only one credit card with limited bonus categories, so point accrual could be slower if only using Bilt.

- The portfolio of credit cards through Chase is greater than both Bilt and United, with more generous welcome bonuses, speeding up points accrual.

- With a traditional cash-back card the value of the points is set, which means I’d need to accrue as many points as necessary to cover the ~$4000 value of the ticket – Yes, I’d need 400,000 points, rather than the ~186,000 otherwise required with a points currency.

So here’s what I did: I opened my first ever business credit card with Chase, the Chase Ink Business Preferred. You can see my post describing the card and its benefits, as well as the application process here.

But what if you don’t travel much?

You may have noticed that I talk a lot about redemptions for flights in premium cabins when I discuss the best cent-per-point redemptions. That is because that’s where the maximum value usually is. But, what if you don’t actually travel much? Are point-earning credit cards useless in those cases?

No, certainly not! But, their use may be more limited. Here are ways that they can still offer good value:

- Some banks offer ‘pay yourself back’ options, where you convert the points to cash. For example, Chase allows this at 1.25 cents per point. Not as good as 2-3 center per point for a business class flight, but still better than the usual 1 cent per point.

- Keep in mind that credit card points don’t expire (though they can lose some value), so any points you amass can become useful when you do go on a trip.

- And on that topic, Chase is fairly unique in that, depending on the credit card you have you can redeem points for up to 1.5 cents per point if booking through the Chase travel portal, in which case you wouldn’t need to go through the trouble of finding good redemptions opportunities and transferring your points. This approach can be valuable for economy redemptions or hotels.

- Finally, you can also redeem points for ‘experiences’, such as shows and dining, though those redemptions may not be as valuable. There typically are also options to redeem at websites such as Amazon, but this typically isn’t a great deal.

Ultimately, the value of points comes from your ability to redeem them at rates higher than 1 cent per point. If you can’t, then that’s where the usual cash-back credit cards may prove more valuable than points rewards credit cards. I plan to delve into this a little bit deeper in a later post.

Summary

In this post I have explored the general types of credit cards one can get, and the power of the credit cards that earn bank’s points currencies over cash-back rewards cards. The former can often prove more rewarding since their value is not pre-determined, and so can often provide in excess of 1 cent per dollar in redeemable value. But, in some situations straight-up cash-back credit cards can prove more valuable, especially if you don’t travel very much.

There is a lot of nuance that I have not discussed here, and these will be discussed in upcoming posts. For now I wanted to give you a basic discussion of these credit cards and to help you understand where you can get outsized value.

Leave a reply to How to Calculate the Value of Your Points – Points to Seats Cancel reply