I recently wrote about how to go about calculating the value of your points redemptions. As you may have noticed, I usually write about redeeming points for business class tickets, but the truth of the matter is that there are a lot of people that want to maximize their points in such a way that they can get the most flights with the least amount of money and points spent. Then, you’d be looking at economy redemptions, as they typically require much less points. I wanted to tackle this topic in this post.

Can you maximize points value in economy?

Here’s the reason I don’t usually consider economy tickets for point redemptions: its difficult to maximize the value of your points with economy redemptions.

I like to think of my points as a currency. The value of that currency can go up or down depending on how you spend it, just like when you buy any other product. Here’s an example: I was recently able to buy the older M2 MacBook Air at BestBuy for $749 (at the time of writing this deal ended). This exact same computer was being sold by Apple for $999. So, given that it’s the same computer that materially has the same value regardless of where you buy it, it’s as if your dollars are worth less if you buy the computer at Apple. My argument is: to me, points should be thought of in the same way.

Let’s apply that idea to flight tickets, using my favorite example: a one way flight from New York-JFK to Amsterdam. First I check Google Flights to explore the cheapest options, and unsurprisingly we find KLM and Delta as the cheapest options. I have a personal preference to take KLM over Delta, so I quickly check the prices on KLM’s website.

Disclaimer: I did these searches about a week ago and these prices are unlikely to be current.

Now let’s have a look at our points redemption options. As always, I’m checking Seats.Aero first, since I find it is the easiest way to quickly see a lot of redemption options. When I search for the same date and check the available flights, we quickly see the same flights pop up, for a range of different redemptions.

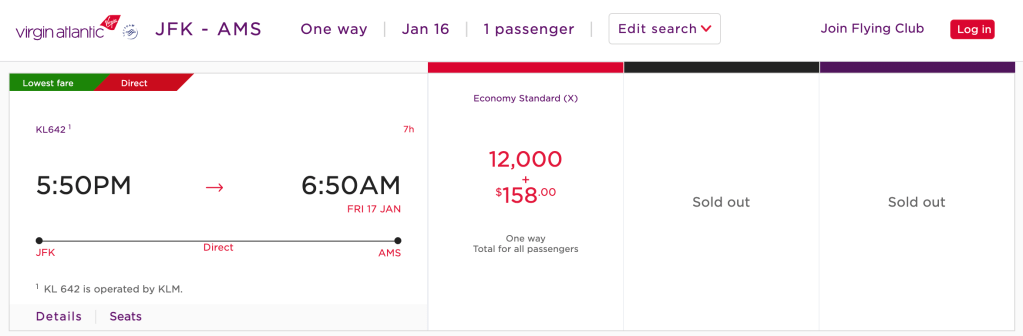

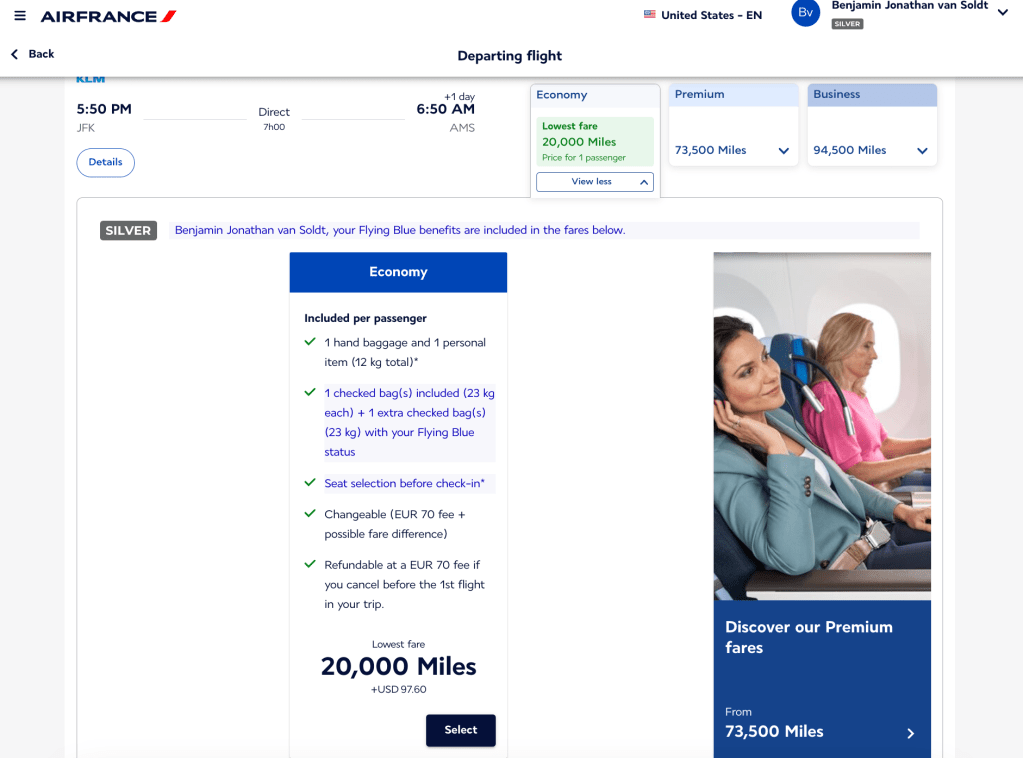

It looks like Virgin Atlantic is the cheapest, but let’s have a closer look at every single one of these options. Because, what we don’t necessarily see in this view is the fees that we may have to pay. Following each link to the different frequent flyer programs through which we can redeem the points for these flights, we see the fee payments required to book these flights, and what economy class we are redeeming for (basic or standard fares).

Now let’s take the cash fare of KLM flight KL642, the different points requirements and taxes and fees, and slot them into the formula to calculate the cent-per-point redemption values of these flights:

- Virgin Atlantic: ((354 – 158) / 12,000) x 100 = 1.63 cent/point

- Air France/KLM: ((354 – 97.60) / 20,000) x 100 = 1.28 cent/point

- Delta: ((354 – 6) / 32,000) x 100 = 1.09 cent/point

As you can see, the best value here is with Virgin Atlantic, but it’s at ‘only’ 1.63 cent per point. This probably seems rather low compared to the valuations that I calculated for the NYC-AMS flight in business class on KLM and Swiss, which was generally in excess of 2 cent per points. And you’d be right: 1.63 center per point is not a particularly good valuation – and it is simultaneously why I tend to say that economy redemptions do not present great redemption value. However, as low as 1.63 cent per point seems, this is a good economy redemption and, if you are set on flying economy, I’d recommend to go for it!

So, while not the best way to maximize points value, there are certainly reasons why you might want to redeem for economy tickets. For example:

- You want to maximize the number of flights that you can redeem for your points, rather than the value of each individual point that you redeem.

- The flight is too short to shell out for a flight that maximizes the point value more efficiently. That is, does it really matter to fly first class on a 1-hour flight?

- You don’t have enough points for a business class redemption.

- You’d like to save your points for another redemption, which then translates to reason number 1 above.

- Perhaps you don’t want or can’t spend the money to generate additional points, so you have to stick with what you have.

I reckon reason number 1 is indeed the number 1 reason to redeem points for economy. Whatever your reason is, redeeming points for economy tickets doesn’t have to mean that you get bad value: meaning, you redeem for 1 cent/point or less. There are still way to get better value, just keep in mind you’d be hard pressed to get the best value when redeeming for economy tickets.

With that out of the way, let’s look at some things to consider.

Bank travel portals vs frequent flyer programs

Besides the usual points transfer to a frequent flyer program, you can also use your bank’s travel portal. For the most part I don’t recommend doing this, as the value of your points will be limited compared to what you can sometimes get through a frequent flyer program. However, for economy award tickets your value could be good – it really depends on the bank your using and the specific credit card.

What bank portal and credit card to use?

The best bank/card combination to use in this scenario is typically the Chase Sapphire Reserve, since this card will allow you to spend your points at 1.5 cents per point in the Chase’s travel portal. If you have the Sapphire Preferred card, it will be 1.25 center per point. Unfortunately most other cards, including any of Capital One’s credit cards, will get you only 1 cent per point through their respective travel portals. As such, I do not recommend using your points to buy flights through bank travel portals unless you’re using points from your Chase Sapphire Reserve to buy flights in the Chase travel portal. I certainly don’t recommend redeeming for business class flights through a travel portal, not in any condition.

A nice but overlooked benefit of redeeming through a travel portal

There is one thing that do I like about travel portal redemptions: since the points in the portal are seen as a cash equivalent, it’s as if you bought your ticket with cash, rather than points. The airline will also treat your ticket as if it were bought with cash, and this means that you are entitled to any kind of miles and loyalty points that the airline would give you after completing your flight. It’s rare that an airline provides this for a flight for which points were redeemed through a frequent flyer program (though Alaska appears to start doing just that). I see this as a return on investment: For example, having redeemed 40,000 points for a flight to Peru through the Chase travel portal (Delta code share on LATAM), Delta awarded me 3000 points and the cash equivalent in Medallion status points to my SkyMiles account.

How do you decide to use the bank travel portal, or a frequent flyer program?

The ultimate question is: when does it make sense to peruse one way over the other? I believe it depends on three things:

- The calculated value of your points, when you redeem them one way or another. Knowing that with the Sapphire Reserve you get 1.5 cents per point, is the value of your points higher or lower when redeeming through a frequent flyer program? Following on from the above example, knowing that you can get a redemption of 1.63 cent/point through Virgin Atlantic, you should go that route and NOT use the Chase travel portal.

- The total number of points you’re spending. To those that want to buy their ticket with points only, it can make sense to use the travel portal since any taxes and fees will be part of the point redemption, rather than an additional charge. However, I would use caution and ensure that the number of points to redeem are reasonable versus the price in points through the travel portal.

- Whether there are any transfer bonuses. Banks sometimes run very lucrative transfer bonuses from their own points currency to that of select frequent flyer programs. For example, Chase recently ran a transfer bonus that would award an extra 30% points for every 1000 points transferred to British Airways Executive Club. This means you’d get 1300 points when transferring 1000 points. These sorts of promotions may last for a month at a time. It’s always good to be on the lookout for these bonuses, as they can really help increase the value of your points, especially for economy flights where the margins on your points value can be quite thin.

An example

Let’s apply this new bit of knowledge the the above example. These were the point values that we calculated:

- Virgin Atlantic: ((354 – 158) / 12,000) x 100 = 1.63 cent/point

- Air France/KLM: ((354 – 97.60) / 20,000) x 100 = 1.28 cent/point

- Delta: ((354 – 6) / 32,000) x 100 = 1.09 cent/point

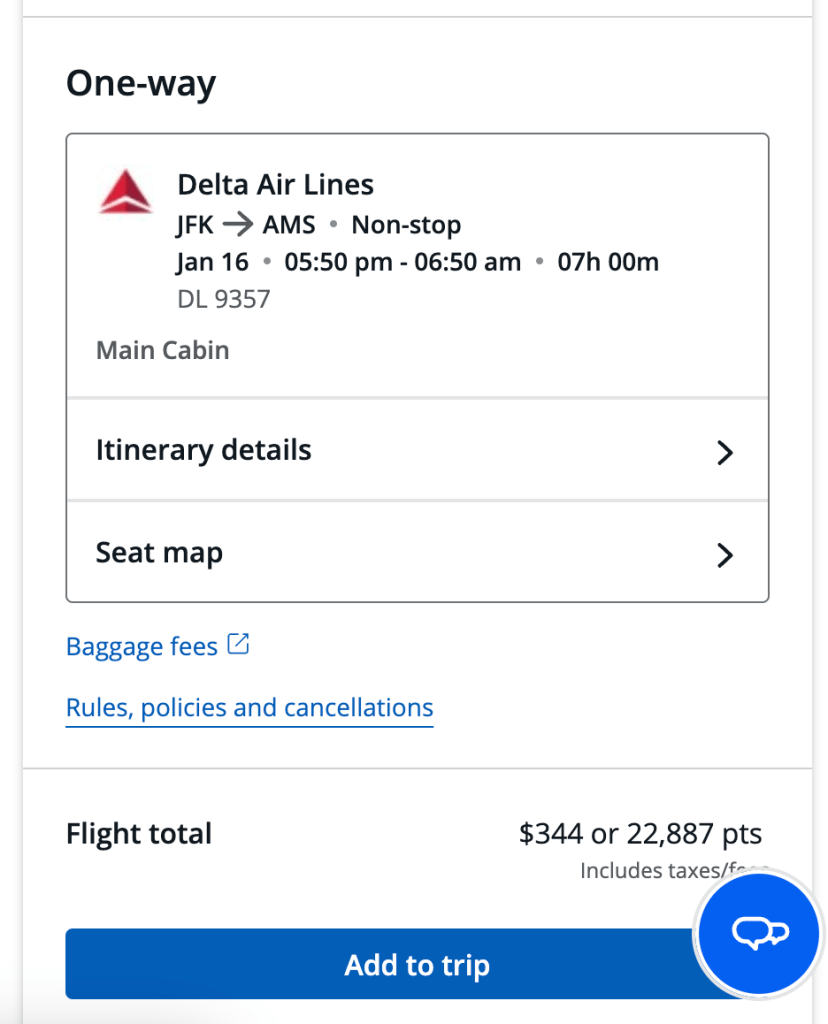

Let’s go to the Chase travel portal and see what price we get quoted. Here, if I look for the same flight, I can see that if I buy this flight as a Delta code share operated by KLM, the quoted price is actually slightly lower in cash, at $344. The points that this will cost is 22,887 points:

If you take the points cost and multiply by 1.5, you’ll get 34330.5 cents, about equivalent to the $344 cash cost of the flight, proving the 1.5 cent/point value at the Chase travel portal when you have the Sapphire Reserve credit card.

So, which route to go? Chase travel portal, or redeeming through a frequent flyer program? Remember the points values that we calculated for the other redemptions. Taking those values into account as well as the above fare:

- With the Chase Sapphire Reserve at 1.5 cent per point, (22,887 points for the above flight) redeeming through Virgin Atlantic Flying Club is the best option, but if you’d like to pay solely with points, the Chase travel portal is still a fair option. Any miles you would get from KLM will help lower the cost of the ticket by likely ~1600 points or so, since KLM awards minimum 5x the cash fare in miles.

- With any other card, I would absolutely recommend redeeming through Virgin Atlantic, even if you’d rather not pay the $158 taxes and fees in cash. If you’d prefer to pay less, the Air France/KLM option would likely still be more lucrative than the bank travel portal.

What if there has been a transfer bonus to Air France/KLM? As a hypothetical, let’s say Chase happened to be running a 25% transfer bonus to Flying Blue. In this case, is Virgin Atlantic still the best choice? In that scenario, you would need 16,000 points only (20,000/1.25 = 16,000). As such, let’s amend the calculation:

Air France/KLM: ((354 – 97.60) / 16,000) x 100 = 1.60 cent/point

With the 25% transfer bonus, the value of the points has gone up drastically. While still not quite as good as Virgin Atlantic, the good things is that Air France/KLM charges much lower fees in cash ($97.60 vs $158). So, for those that prefer paying the lowest cash fees, Air France/KLM now becomes a good alternative to Virgin Atlantic. And as a personal preference, I like to redeem points with the operating airline rather than another airline, since the operating airline will have more control in case of irregular operations.

Summary

In this post I looked at the best ways to redeem points for economy tickets. Generally, I find that points redemptions for economy will never allow you to maximize the value of your points, but for many of us, getting the necessary points to fly premium cabins may not be possible, or you may simply not want to spend that many points. In that case, it is still possible to maximize your points value, you’ll just need to compromise a little.

For economy flights, I consider 1.5 cent/point a good redemption value. Chase Sapphire Reserve card holders will get this by default through the Chase travel portal, so they will be guaranteed this rate no matter what. This can often be a good way to redeem points for economy flights, but always do your homework to see if you cna get better value for your points by redeeming through a frequent flyer program.

Need help finding the best economy redemptions for your flights? I’m happy to help! Reach out through the contact form and I can help you maximize the value of your points.

Leave a reply to Best-ever welcome bonus: I just got the Chase Sapphire Preferred (again)! Here’s how you can get it too – Points to Seats Cancel reply