I have always touted the Chase Sapphire Reserve as an expensive but highly rewarding credit card that is well worth the high annual fee ($550), thanks to its lounge access benefits, global entry credit, and a variety of other perks, including a $300 travel credit.

A little while ago, Chase has unveiled a revamp of this popular premium credit card that for some may turn out positive, and for others… not so much. This revamp has gone live as of June 23rd 2025! Let’s take a look at the changes.

- Annual fee increases from $550 to $795, authorized user fee from $75 to $195

- Changes to earning categories

- 1.25-1.5x points value no longer; welcome ‘points boost’

- New hotel, entertainment and dining credits

- Other miscellaneous perks

- Things that stay the same: travel credit, lounge access, global entry

- Is the Chase Sapphire Reserve still worth it?

- Summary

Annual fee increases from $550 to $795, authorized user fee from $75 to $195

The most obvious change is probably the increase in the annual fee. Currently the annual fee is $550, so this will be raised by a whopping $245 to $795. In addition, whereas authorized users used to cost $75, that fee will now go up to $195, representing a massive increase of $120. Both increases are significant, but if the other perks balance out that increase in fees, the card could still be worth it. So, what do you get for that fee?

Changes to earning categories

The first set of perks that will change are the earning categories. These used to be well-balanced and quite lucrative. These are now being rebalanced in a way that clearly favors spending through Chase:

| Current category | Revamped category |

|---|---|

| 10x points on hotels and rental car booking through Chase travel | 8x points on all Chase Travel purchases |

| 5x points with Lyft | 5x points with Lyft |

| 3x points on all dining | 3x points on all dining |

| 3x points on all travel | 3x points on flights and hotels booked directly with airline or hotel |

| 1x points on everything else | 1x points on everything else |

Here is what stands out to me: there is a clear shift from spending on travel outside of Chase travel, to spending with Chase Travel. Not only is 3x points on all travel being dressed down to only being for flights and hotels (so no extra points for the subway, parking, etc), now all travel purchases through Chase Travel will get you 8x points. This is a pretty huge increase that may make it worthwhile to book through Chase. Personally though, I’m not a fan of that. It’s usually best to book directly with the airline you’re flying, as that gives the operating airline all the liability to help you if something goes wrong.

1.25-1.5x points value no longer; welcome ‘points boost’

One of the great things about the Sapphire cards is that the points are more valuable through Chase Travel. If you redeem for economy, Chase Travel may very well give you the best value, pretty much without restrictions. Well, that’s coming to an end now.

Chase will be removing the 1.25-1.5x points value when redeeming through Chase Travel for any points earned as of June 23rd 2025, the day the card launches. However, it does seem like points earned under the old scheme will retain that value until October 2027, so Chase is giving existing card holders the chance to redeem against the old ‘static’ value of 1.25x if you have the Preferred, and 1.5x if you have the Reserve. If you do have the reserve, you therefor might want to move your points from other cards to the Reserve points account before June 23rd, to get the higher valuation.

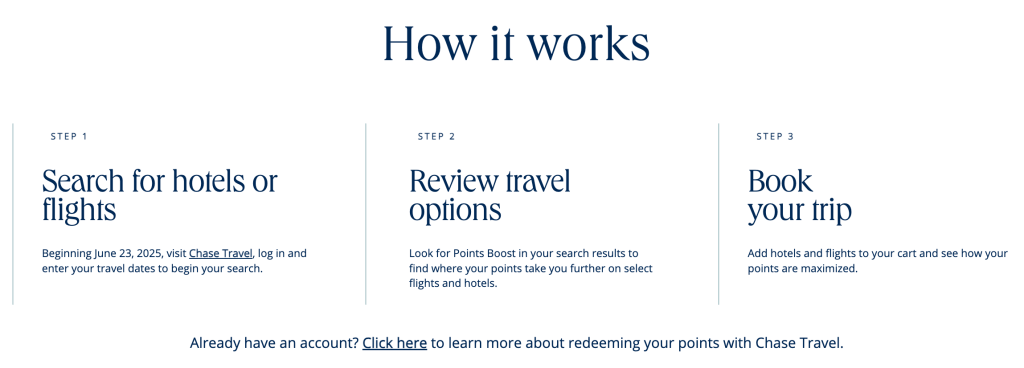

So how is this changing? Chase is introducing ‘Points Boost’. The way this works is frankly still a little bit nebulous, but what we do know is that the points value will be dynamic, and go from 1.25-2x depending on class of service and airline. I imagine this will work in a way where the redemption value will be correlated with the price range of the ticket, so that economy flights will be on the lower end and first class on the higher end. As you can see, the two examples given below for 2x points value are high-end, expensive travel experiences, not your run-of-the-mill economy flight with Spirit…

In terms of how you would know what you’re getting, the below is Chase’s explanation. You’d have to plan your trip, add to cart, and then see what you get – so essentially you’d have no idea what points value you get until you’re about to check out. Seems like a pretty big degradation in terms of convenience and user experience…

New hotel, entertainment and dining credits

Many credit cards these days are adding monthly, quarterly or semi-annual credits that you can redeem for specific purposes. For the credit card issuer, these are fairly straightforward ways that at face value can offer a significant return on spending. But for the consumer, these can be quite irritating, as you need to remember and keep track of them in order to ensure that you get your money’s worth. As a matter of fact, I’d think the issuer hopes people are too lazy to track these, and I imagine this is a good way for them to make money (or rather, retain the money earned on he annual fee).

With that said, what are the new credits you get that could offset the increased annual fee? See below:

- $500 credit with The Edit: Chase Travel’s selected high-end hotels. 2 semi-annual credits of $250.

- $300 credit when dining with Sapphire Reserve Exclusive Tables, Chase collaboration with OpenTable for booking sought-after prime-time restaurant bookings with participating venues.

- $300 credit for DoorDash, in monthly credits (5$ for restaurants, and two $10 credits for groceries, retail orders etc).

- $300 StubHub credit, in 2 semi-annual credits, for purchases for entertainment and experiences.

- $120 Lyft credit, in $10 monthly credits.

- $120 Peloton credit, provided annually

At face value, these credits stand for close to $1500 in annual credits, which therefor far exceed the $795 annual fee. The key point here is to be realistic about how useful these perks actually are for you. For example, the $500 credit for The Edit sounds fantastic, until you realize that it requires a minimum 2-night stay at hotels such as the Six Senses Ibiza and the Fifth Ave Hotel – i.e., high-end hotels where the $250 credit may just equate to a 25% discount on the full stay. In other words, you’d need to spend hundreds of dollars in order to use the credit. So did you really save money there…? One thing to add: you do get a $100 property credit, breakfast for 2 and room upgrades, if available. So, that’s nice.

One more thing. Of all these credits, the DoorDash credit is probably the most useful to all kinds of users, but the implementation is also the most user unfriendly, given that these are not only broken up into monthly credits, but this is then also broken up into 3 smaller credits. This makes it difficult to fully utilize unless you carefully track how each credit was used.

Other miscellaneous perks

Besides everything I’ve covered so far, there’s a few perks that don’t quite fit into other categories:

- The card comes with a subscription to Apple TV+ and Apple music, valued at $250 per year.

- You can get IHG Platinum Elite status until late 2027. This is the same elite status that you can get with the $95 annual fee IHG One Rewards Premier credit card, and comes with space-available room upgrades, among other perks.

Also, you can get some extra perks if spend at least $75.000 per year on the card:

- Rather than IHG Platinum Elite status, you can get IHG Diamond Elite status, which also gives you free breakfast, among other things.

- Southwest A-list status, which provides some useful perks for those that are Southwest frequent flyer, including priority checkin and boarding, free first checked bag, same-day standby and 25% mileage earning bonus.

- A $250 Southwest travel credit.

While the IHG status is a very nice addition, I think it’s kind of funny that you get perks with Southwest, of all airlines… It just seems to me that Southwest’s operation (in its current form) doesn’t really fit the profile of the average traveler that the Sapphire Reserve seems to target, so this doesn’t make a whole lot of sense to me.

Things that stay the same: travel credit, lounge access, global entry

Fortunately there is a contingent of perks that stays the same, and those are some of the ones that are the most popular perks:

- The $300 annual travel credit remains unchanged. This very easy-to-use perk will work towards any travel purchased, regardless of whether it’s through Chase Travel or not.

- Access to Chase Sapphire Lounges. Chase has been working for a while to open Chase Sapphire Lounges at various airports, and currently there are lounges at Boston, New York LaGuardia, New York JFK, Philadelphia, Phoenix, San Diego and Hong Kong, with two more lounges coming in Las Vegas and Los Angeles (LAX). These lounges are typially high quality with great food and drinks and lovely design. I have previously reviewed the Sapphire Lounge at New York-JFK Terminal 4, and loved it.

- Lounge access through Priority Pass. This complimentary lounge membership grants access to over 1300 lounges worldwide. Most major airports will have one, and while they may not necessarily be the best or nicest lounges, it often still beats sitting in the terminal…

- Access to select Air Canada Maple Leaf Lounges, if you’re flying with a Star Alliance member airlines. All Air Canada except the lounges in Montreal appear to be included. While I haven’t posted that specific review yet, I did get a chance to try the Air Canada lounge in Frankfurt, and though it was a very nice facility.

- The $120 Global Entry and TSA PreCheck credit remains unchanged as well, and will still be available going forward.

It’s good Chase has not changed these perks, and for those of you traveling a lot, access to these lounges may go a long way to offset the cost of this credit card.

Is the Chase Sapphire Reserve still worth it?

The above are the big ticket changes from the current to the revamped Sapphire Reserve. Fundamentally, is the new annual fee worth it with the extra perks?

Personally, I’m not so sure. For me, the $300 travel credit, lounge access, and 3x points earning on all travel were the most important reasons to hang onto this card. The announced revamp changes how the value balance for me:

- The persistence of the $300 travel credit brings the annual fee down to $495 for me, so that’s good.

- The bonus categories are not so bad, admittedly. While I’d lose extra points on the subway or train, at least flights and hotels booked directly with the airline or hotel will go to 4x (from 3x), and booking through Chase Travel will give 8x points, which is a substantial increase. Unfortunately, I do find that hotel booking are more expensive through Chase, although flights are usually on par with the airline’s quotes. With this rebalancing, I think my points earning will likely be not so different between the current and new categories, so this won’t change the overall valuation much.

- The points boost feature is still a mystery to me. On paper it’s great if you can redeem for 2x value, as then you may not need to transfer points to airlines for the best redemption value. That said, given how specific the terms seem to be, I don’t think the 2x valuation will be particularly widespread. We’d need to wait and see how this works.

- The lounge access is great, and admittedly was an important reason for me to have this card. But with the higher annual fee, I can’t justify having the card ‘just’ for the lounge access, even after deducting the travel credit. This is because, realistically, I fly perhaps 3-4x per year, and may not always fly through the airports and terminals that have the participating lounges.

- The additional slew of perks that has been made available are not all that useful to me. This definitely comes down to personal preferences, but to me a lot of these perks would require me to spend money in ways that, if not for the perk, I’d simply not engage in. The DoorDash credit is the best example; I never use DoorDash, so I’d need to especially use it and spend money on takeout just to get the credit. Besides, the implementation makes it hard to maximize this, and it’s very likely money will be left on the table there. Further, credits like for StubHub, The Edit or Sapphire Reserve Exclusive Tables are more of the same. The Edit is specifically problematic, given the price ranges of the participating hotels.

So, will I upgrade down the line back to the Sapphire Reserve, as I had originally planned? I’m not so sure. I may give a renewed look at the Capital One Venture X or even the Amex Platinum card…

Summary

Chase has today unveiled massive change to its Sapphire Reserve credit cards, with a substantial increase to the annual fee for the primary card member and authorized users. While lounge access and travel credit stay the same, there is a enw slew of additional credits that can unlock further value, but personally I find these perks not very appealing, and those that have the most practical use are also the hardest to maximize. Finally, the rebalancing of the bonus categories could potentially give good value, with higher points earning on flights, through Chase Travel, and persistence of the 3x dining earning. But, overall, I’m not too sure if the Reserve is still the right card for me. The Capital One Venture X may offer perks I care about at a lower price point.

Leave a reply to Analysis: The revamped American Express Platinum card: a valuable coupon book for those with patience – Points to Seats Cancel reply