Citibank recently released two new credit cards, the Strata and the Strata Elite. Together with the existing Strata Premier credit card, forms Citibank’s new Strata family of credit cards. I published an analysis of these cards with my recommendations for whom would profit of these credit cards. In my conclusions, I seemed lukewarm about the premium ‘Elite’ card, with its high annual fee, yet today my husband applied was approved for this card at my insistence, so what gives? Did I change my mind?

- Basic details on the Citibank Strata Elite

- Why the Citibank Strata Elite works for us

- Hidden in-branch offer of 100k points!

- Summary

Basic details on the Citibank Strata Elite

Welcome bonus: currently 80.000 ThankYou points after spending $4000 in 3 months (but continue reading for a hidden, higher welcome bonus).

Annual fee: $595, which is high, but lower than most of its competitors: Chase Sapphire Reserve has a $795 annual fee, the Amex Platinum $695, while the Capital One Venture X is at $395.

Bonus categories: This card has an interesting set of bonus categories that’s not necessarily unique for premier rewards cards, but the implementation is:

- 12x points on hotels, car rentals and attractions booked through Citi travel.

- 6x points on air travel booked through Citi travel.

- 6x points for restaurant purchases made between 6PM-6AM on Friday and Saturday (termed ‘CitiNight purchases’)

- 3x points on restaurant purchases at all other times of day.

- 1.5x points for everything else.

Additional benefits: This card does come with some useful benefits:

- 4 American Airlines Admirals Club Lounge passes, to be used by the primary card holder and their trip companions when traveling on American Airlines or a oneworld partner.

- A Priority Pass membership.

Additional credits: Like all premium credit cards these days, the Strata Elite has a bunch of credits that will help offset the annual fee, with varying usability depending on your spending patterns:

- $300 hotel credit: annual credit for a hotel stay booked through Citi travel, for stays of 2+ nights.

- $200 ‘splurge’ credit: annual credit that can be used on 2 out of 5 selectable merchants (1stDibs, American Airlines, Best Buy, Future Personal Training, and Live Nation).

- $200 Blacklane credit: 2 semi-annual $100 credits with Blacklane, which is reservable chauffeur service.

- $120 TSA PreCheck/Global Entry credit: credit applied for an application for TSA PreCheck or Global Entry once every four years.

Why the Citibank Strata Elite works for us

I’ve posted before on how to calculate whether you can maximize a card’s value, by systematically evaluating the various credits and benefits and seeing how that stacks up the the annual fee: can you recoup the annual fee? If not, the card is probably not worth it for you.

In my mind, the Strata Elite is a card that is especially useful if:

- You like to eat out specifically Friday and Saturday night, thanks to the elevated 6x bonus points for restaurants at that time only.

- You value a priority pass membership for you and your partner, and don’t have this benefit through another card. The partner angle is important, sicne authorized users are $75 and get their own priority pass membership. Right now, this is the cheapest way for an authorized user to get a prioprity pass membership.

- You want to redeem points through American Airlines AAdvantage, since Citibank is the sole transfer partner for American Airlines. AAdvantage still is a very appealing program, especially for partner redemptions in the oneworld alliance.

Here’s the thing: these three points apply 100% to us, and so from that point of view, this card fits our needs very well. But, can we recoup the annual fee? Let’s look at the credits:

- $300 hotel credit: This is very easy to use, since you can book 2 nights and get the entire value of the credit in one go. We will definitely use this.

- $200 ‘splurge’ credit: I envision using this to buy tickets with American Airlines, and so we will very easily be able to use this.

- $200 Blacklane credit: This is a little more complicated, as it comes as 2 semi-annual credits. Here’s the thing: I found that I can reserve a Blacklane car from New York-JFK back home for about $150. With the $100 credit, that’s $50 – that’s cheaper than Uber or a yellow cab. Hence, I can see we would do this when coming back from a long trip (such as our upcoming Thailand trip).

- $120 TSA PreCheck/Global Entry credit: This we will definitely use, but only applies once every four years. So this is more like $30 per year.

Summing it all up, we will be able to get back $730 per year from the credits alone, not taking into account the value of priority pass or the Admirals Club passes. That’s more than the annual fee of $670 ($595 primary + $75 authorized user). I actually think that if we were to book a long weekend trip to Los Angeles, for example, we could maximize all the credits in one fell swoop.

So in my book, this card is worth it for us! But of course, your mileage may vary and you should do this analysis for yourself.

Hidden in-branch offer of 100k points!

But here’s the real kicker. If you go online and read the average blog post (including my analysis), you’ll see reference to the 80.000 point welcome bonus, which is available online.

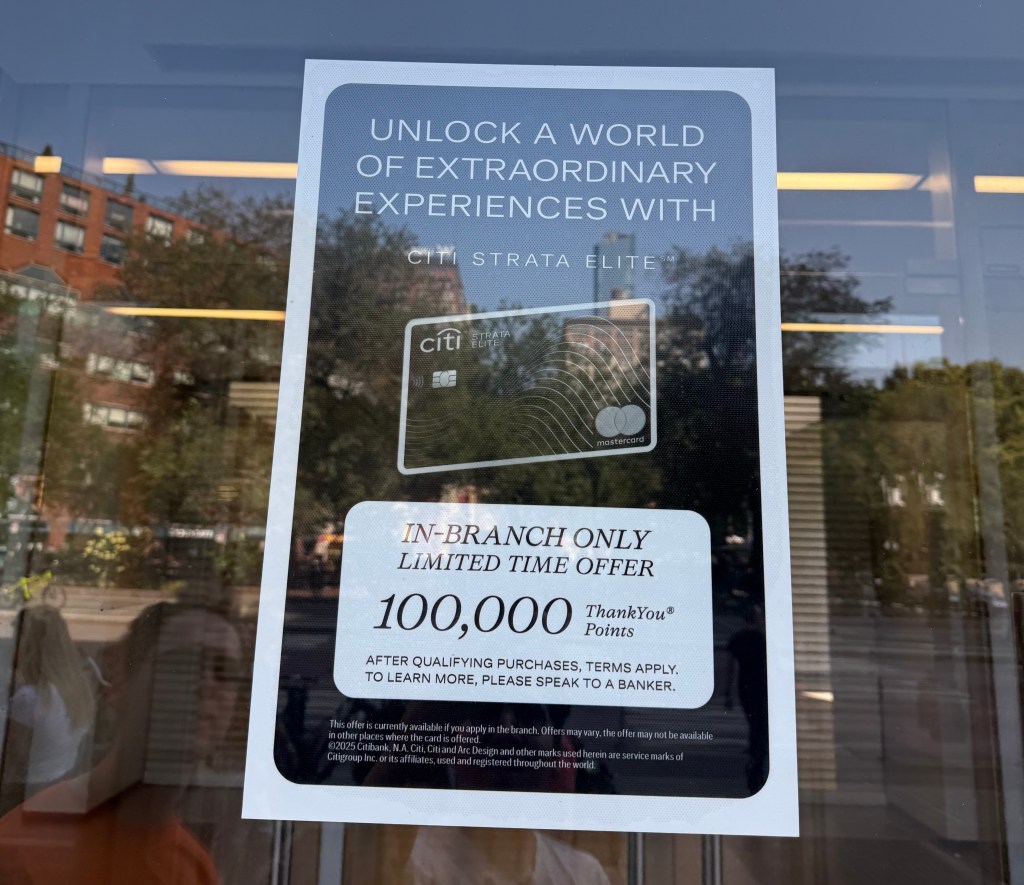

Last weekend, my husband and I walked past a Citibank brnach around the Union Square area in New York City, and saw the below, rather informal-looking notice on the window:

This is very real! My husband today applied for this card and received the 100.000 welcome bonus, but this offer is only available if you apply for a card at the branch. So, do not apply online – apply at the branch instead. Any of them should do, but I don’t know when this offer may get pulled. So if you’re planning to get the Strata Elite, I’d suggest to do it sooner rather than later.

Summary

My husband applied and was approved for the Citibank Strata Elite, Citibank’s newest premium card. This card really isn’t for everybody, but after analyzing the annual fee, credits and other benefits, I determined that we will be able to maximize the credits quite easily, and with that will be able to recoup the annual fee fully. On top of that I expect us to get a good return with the 6x points on restaurants Friday and Saturday night, and since we don’t have priority pass memberships through other card, that’s also a very welcome benefit. Finally, if you do want to apply for this card yourself, do so at a branch rather than online in order to unlock a 100k points welcome bonus.

Leave a reply to My Favorite Rewards Credit Cards to Maximize Your Points Earning (October 2025 Update) – Points to Seats Cancel reply